An Post Money research reveals scale of financial worry as inflation squeezes

Two new studies commissioned by An Post Money in January and May 2023 show the psychological impact the spiralling cost-of-living crisis is having on the public. Financial planning for the future has taken a back seat with a sharp focus instead being placed on managing escalating day-to-day living expenses.

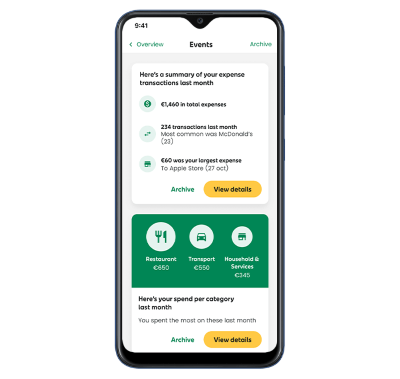

In support, An Post Money has launched a number of initiatives to help put financial power and control back into the hands of the public. An Post Money announced that its Money Manager smart budgeting tool is now available for FREE to everyone in Ireland, not just An Post Money customers. The Money Manager budgeting tool allows users to securely link their current accounts and credit cards in one place so they can track their spending in real time. Spending and budget alerts show users when they are approaching their personally-set limits enabling consumers to adjust their spending accordingly, while useful insights, like unusual transaction patterns, and insights including splitting spending into various categories so money can be mapped and tracked on an ongoing basis.

Existing An Post Money customers can use their ten-digit User ID to access the app once downloaded. New customers who wish to use Money Manager should download the An Post Money app today on the App Store or Google Play and link their accounts.

In collaboration with leading financial advisor Paul Merriman, An Post Money offers practical financial advice and guidance to support the public with their biggest financial concerns and giving control over finances. The new An Post Money Digital Hub at www.anpost.com/moneyhub provides videos, blogs and advice on how best to manage key financial matters. Blog themes range from tackling utility bills, managing mortgage/rent payments and grocery shopping efficiencies to getting off the debt ladder, claiming important expenses, protecting incomes with insurance, and purchasing big ticket items. An Post Money has also selected five households to receive free financial guidance from Paul Merriman over six months (March to September 2023) in achieving their financial goals while teaching them about the importance of financial planning. Each will share video details of their personal journeys such as saving for a first home deposit and getting mortgage ready, starting a pension, building an emergency savings fund, or working towards a specific financial goal, inspiring the nation to get on board and take back control of their finances. Follow the progress of the five participants and avail of free financial tips, information and advice from Paul Merriman, putting financial power back in their hands through www.anpost.com/moneyhub.

Speaking at the launch of the initiative Paul Merriman said ‘The research findings are stark yet unsurprising and prove that An Post Money Manager is exactly what people need right now. As the purse strings tighten at home, attention turns to managing the day to day and making sure we keep the lights on and put food on the table. However, I am concerned to see so many putting their long-term financial plans on the back burner because, what might seem like a low priority now will quickly become a big priority in five or ten years and this is something we are going to address over the coming weeks and months.

“I’ve had the pleasure of meeting our five participants and the great thing is that each of their stories is relatable for so many. While we can’t sit down with the entire country, we hope that people across Ireland will be able to find similarities between their situations and those of our participants and take the actionable tips and advice and apply these to their own circumstances’.

Debbie Byrne, Managing Director of An Post Retail said “We are steadfast in our commitment to offering An Post Money customers a better digital banking experience to manage their everyday banking needs, enabling them to take control of their finances and build better financial habits. I am delighted to announce that our Money Manager smart budgeting tool is now available for free regardless of who you bank with, not just An Post Money customers. Money Manager allows users to securely link their current accounts and credit cards all in one place. They can track their spending in real time and set up spending and budget alerts to help them stay on track, while giving them a deeper understanding of their financial behaviour over time. This new offering demonstrates our commitment to financial empowerment, helping consumers to make the most of their money, particularly as they try to navigate the rising cost of living. We are also delighted to partner with Paul Merriman to offer consumers hands-on advice and real-life financial tips”.

Research Results

The research reveals a sense of a lack of control as people in Ireland try to keep afloat in the short-term but are stressed over their inability to prepare for their own future and the future of their children. Unexpected outgoings such as medical bills and motor or household item repairs are also an increasing cause of anxiety. The study shows how concerns have risen between January and May 2023 with no sign of receding. Financial anxiety has increased significantly across several areas with concerns around grocery bills seeing the largest rise as the area consumers are most concerned about. Home energy remains the top financial concern facing Irish people despite energy credits and moving out of the winter period. Accommodation costs remains a key challenge facing the country with a surge in those worried about their rent and mortgages, while renters are finding it harder to get on the property ladder. Against this backdrop, there is frustration amongst some that incomes are not rising at the same rate as inflation, while others are concerned about how far their current or future pension will go if inflationary trends continue.

- Close to nine in ten (87%) respondents expressed one or more financial concerns for the year ahead, up two percent since January 2023

- Home heating and energy bills represents the largest financial concern causing 65% of respondents to worry, up from 60% in January 2023. One in four (23%) say this is their main financial concern, down 11 percent as winter ended.

- With grocery price inflation hitting a record high in April 2023, 63% are worried about grocery bills, up from 57%. Close to one in five (18%) say this is now their main financial concern, an increase of 38 percent since January 2023.

- 45% of respondents are worried about accommodation costs (rent or mortgage payments), up from 37%. Over one in five (21%) say this is their main financial concern, an increase of 17 percent.

- Motor expenses are a cause of worry for close to three in five (58%), up from 55%

- One in two (51%) are concerned about insurance costs, up from 42%

- Over four in ten (42%) of respondents are concerned about medical and dental expenses, up from 33% in January 2023

Highest financial anxiety demographic breakdowns

Gender – Women record increased concerns over a wider range of areas since January, but especially around grocery food shopping bills (67%), home heating/energy costs (67%), and medical/dental expenses (47%). Women are significantly more likely to be concerned about groceries or medical bills than men. Both men and women recorded increased concern over both Insurance payments and mortgage/rent payments.

Age segments – The 35-54 year old age segment has recorded a significant increase in concerns across a multitude of areas, with mortgage payments (36%) a particular source of anxiety. This cohort is also more likely to show higher concern for credit card bills (23%), compared to other age segments. 18-34 year olds are far more concerned about the cost of rent (44%) and transport costs (25%). Those 55+ show the highest concern about home heating and energy costs (68%) and home insurance costs (31%) relative to younger cohorts, but significantly less concerned about rent (9%) and mortgage payments (12%).

Social grade – Those in the C2DE social grade are experiencing higher levels of anxiety than the ABC1 social grade around grocery and food shopping (66%), personal loan repayments (26%) , while ABC1 grades are more concerned about mortgage payments (30%) and health insurance (34%).

Provinces – Those living in Dublin are feeling the pressure of rent (33%) and mortgage payments (31%) plus credit card bills (23%) more than those living outside of Dublin. Those living in Munster (66%), Connacht and Ulster (65%) are feeling the pinch more in motor related costs than those living in Dublin (50%) or the rest of Leinster (55%).

Longer-term financial concerns

A seemingly unrelenting financial squeeze is casting a long shadow over people’s long term financial plans and sense of security. Respondents expressed deep concern that they were unable to put money aside for savings plans, pensions, education funds, emergencies, holidays, home improvements and retrofits or important occasions.