OK real talk. Does anyone is their twenties ACTUALLY know how to manage money?

I'll be the first to amit that finances aren't exactly my strong suit. Sure, I've got a roof over my head, food in the fridge and a Netflix subscription to keep me going, but when it comes to savings and long-term planning, I may as well be back at square one.

However, I'm slowly but surely learning how to make better choices when it comes to spending, and there are a few golden tips and tricks I've picked up along the way:

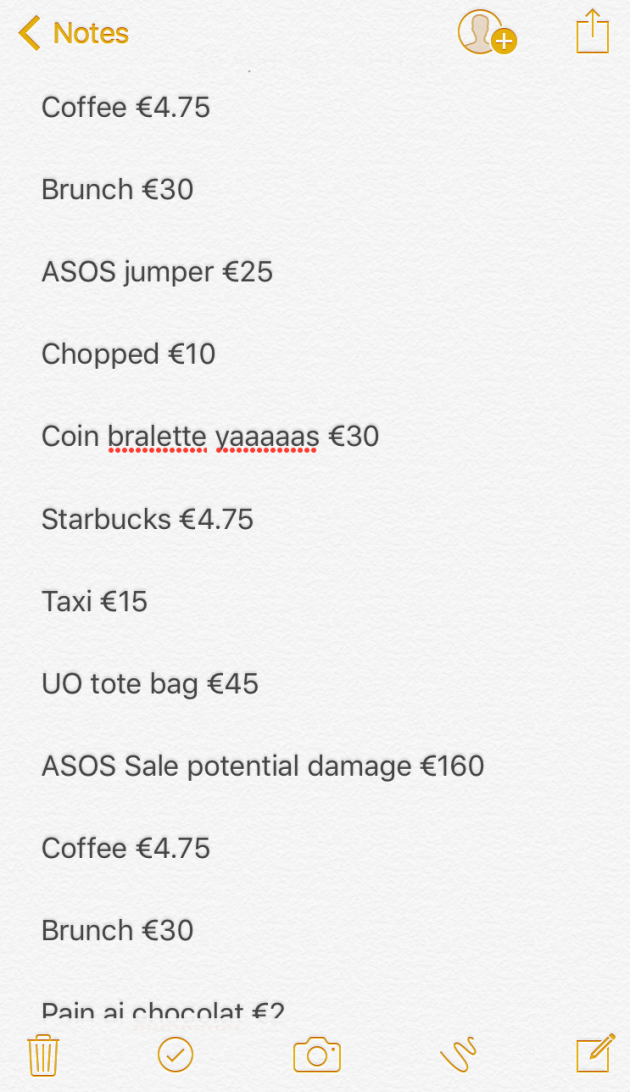

1. Thou shalt keep a budget book

Budgeting is hard, OK? And in an age of paperless money, it can be easy to lose track of your finances.

One way to combat this is to keep a budget book, mapping out all your incoming and outgoing expenses for the month ahead, including every single purchase you make.

Break down your earnings using the handy 50/30/20 ratio – 50 per cent goes towards living expenses, 30 per cent is disposable income, and 20 per cent goes into savings.

2. Thou shalt take advantage of loyalty schemes

Whether you're earning points on your club card every time you do a food shop, or simply getting a free coffee every two weeks, loyalty schemes are a great way to save the pennies without feeling like you're missing out.

A number of banks also offer reward schemes, allowing customers to earn cash back when use their cards at selected retailers.

3. Thou shalt limit my online spending

Sure, the half price ASOS jacket might seem like an absolute steal, but it's a slippery slope.

First the jacket, then the shoes, and before you know it, you're basket is full to brim with items you probably (definitely) don't need.

4. Thou shalt refrain from taking out loans

Unless absolutely necessary, try your best to work with what you have.

But if you do find yourself in a position where borrowing money is the only option, make sure to shop around for the best interest rates, and make paying it back an absolute priority.

5. Thou shalt bring my lunch from home

OK, so this one's a bit of a no-brainer, but eating out is pricey AF.

Give the artisan breads and lavish salads a break and start getting creative in the kitchen.

Pro tip: Make more than you need to eat for dinner so you can use the leftovers the next day.

6. Thou shalt eat more veggies

Meat is by far one of the most expensive parts of any meal, so it's no surprise that cutting it from your diet will do wonders for your pocket.

Can't commit to the full veggie life? Start with meat-free Mondays and go from there.

Your bank account will thank for for it.

7. Thou shalt entertain at home

Save the big nights out for special occasions – birthdays, anniversaries, going-away dos etc. – and do the rest of your socialising at home.

You'll save a bomb on taxi fares, cover charges and over-priced cocktails, and hey, you'll probably have more fun.

8. Thou shalt save as much as possible

Got a few quid left over at the end of the month?

Rather than indulging in an unnecessary spending spree, put your precious pennies towards a bigger spend.

After all, that two month trek around South East Asia isn't going to pay for itself.

9. Thou shalt learn about taxes

OK, so this one is easier said than done, but it's important to know where your money is going every month.

For example, Irish workers are entitled to a number of benefits including dental and optical, as well compensation for absence due to illness.

It's also worth checking whether you've been emergency taxed in the past four years. You could be owed a small fortune and not even know it!

10. Thou shalt splurge responsibly

While it's essential to stay on top of your finances in your 20s, it's never fun to deprive yourself of the things you want.

Whether it's the designer handbag you've been lusting after, or the holiday of your dreams, it's important to treat yo'self every once in a while.

After all, you worked hard for the cash – just spend it wisely!