OK, so you're at a time in your life when you want to open a savings account.

You have a secure job and are now looking into the future – and opening a savings account is one of the smartest things to do.

Whether you want to save for a holiday, a home, or just a rainy day, there are many options available to you, but sometimes the thoughts of having to liaise with banks and figure out which one is right for you can be tricky.

Here, we're going to break it all down for you, so you'll know what the right steps are for when you want to take that step in your life.

How does it work?

A savings account is one of the most basic types of accounts you can open, whether it's in a bank or credit union.

The account holds your money, pays interest on your savings and gives you a number of options for withdrawing your cash.

Once you're ready to spend your moola, you can choose to withdraw it directly or put it into your regular account.

How to make the first step

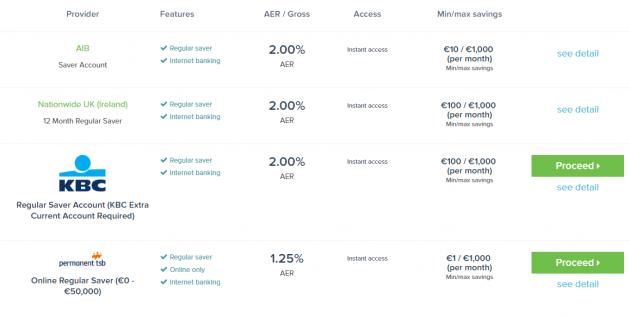

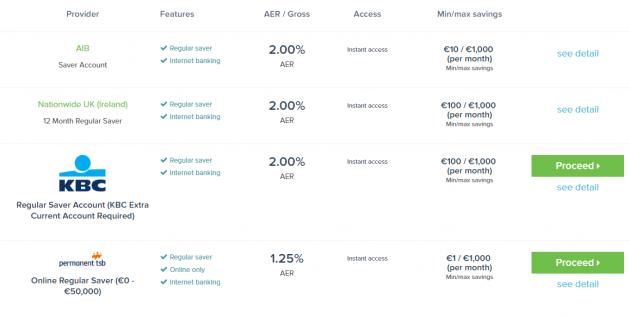

The first step to opening a savings account will be to find the bank/credit union that suits your needs. We would suggest heading onto Bonkers.ie, as they will compare all Irish banks to help you find the best savings, deposit accounts and interest for your money.

They are regulated and will give you up-to-date information so you have the comfort of knowing you're getting the best out of your own unique requirements.

So whether you have a regular account with AIB, Bank of Ireland, KBC, Permanent TSB or Ulster Bank, they will break down all of information so you can figure out whether you need to stay with your primary institution or switch banks to get the best rates.

What's next?

Once you know which bank you want to go with, you need to be strict with yourself and actually put a substantial amount of money in on a weekly or monthly basis.

Whether you just start off with €20 a week, and grow it from there, you'll be surprised with how much you can save over time.

What to look out for

Make sure you know when you're able to withdraw money from your account. It's not advisable to do so unless you're spending the money on your goal (a house, car, holiday, etc), but as we all know, sh*t happens.

Some banks will allow you to withdraw the cash whenever you want, but some have a holding period and you will have to submit a form which could take a week or month to process, meaning you won't be able to access your money for up to 30 days afterwards.

Basically, always read the small print before you commit to anything.

We know that this can be a scary and daunting thing, but you'll be only delighted when you have that money in the future. Discipline yourself and you'll reap in the rewards in a few years time.